MYOB’s new HR platform is funnelling people into a high-fee super fund

Consumer advocates say the platform may lead to a return of the ‘bad old days’ of superannuation.

Need to know

- An onboarding platform for new employees, owned by MYOB, is leading Australian consumers toward Slate Super, a brand MYOB owns through its subsidiaries

- Outdated government processes make it difficult for consumers to find and stay in a good super fund

- Super Consumers Australia calls for the government to make it easy for people to choose and keep a single, high-performing fund when they change jobs

Starting a new job can be overwhelming – you’ll probably be focused on getting across your new responsibilities and workplace and fitting in with your new team. Choosing or keeping a super fund can easily be put to the back of your mind, especially if the process is time-consuming and messy.

An online onboarding software program used by employers offers a new way to choose a super fund when you change jobs. The platform, branded FlareHR, was recently bought by MYOB, an Australian multinational tax and accounting software provider.

But consumer advocates have concerns that the platform is encouraging people to join Slate Super – which so far has delivered relatively poor performance with high fees. MYOB owns the Slate Super brand, website and app through its subsidiaries.

How MYOB’s onboarding platform works

When you start a new job, your employer may ask you to fill out a standard ATO form to select a fund or keep your existing super fund.

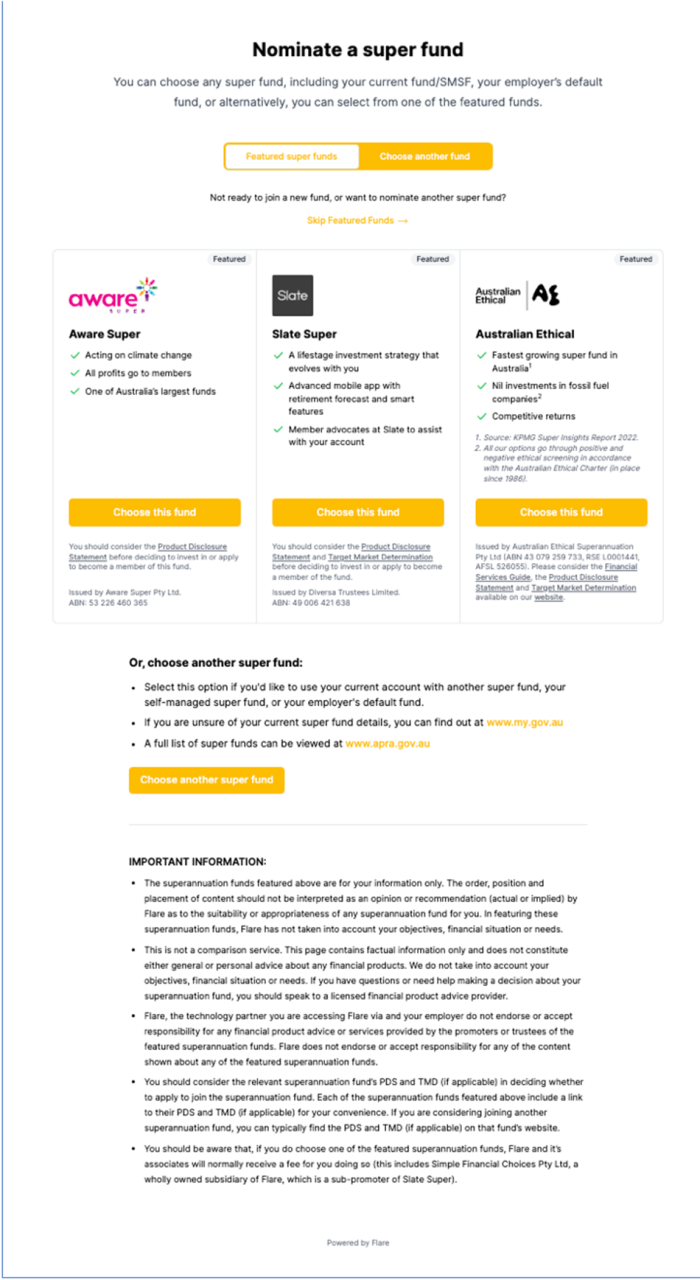

MYOB’s onboarding platform digitises this process and displays their ‘featured funds’ more prominently than the options to either choose another fund or skip and keep your existing fund.

Screenshot from the MYOB onboarding software that shows how their preferred featured funds are more prominently displayed.

The software asks you to nominate a fund, even if you already have one.

Screenshot from MYOB onboarding software titled ‘Important information about super’.

If the user wants to keep their current fund, they enter the fund’s name or Unique Superannuation Identifier (USI) and their member number. This contrasts with the reforms to super introduced in 2021 that allow ‘stapling’ – to ensure your super moves with you from job to job, so you can simply do nothing – no forms, no looking up member numbers – and still retain your current fund.

A CHOICE staff member also obtained a demonstration of the onboarding platform. In the demonstration, the user had to click through Slate Super and another fund that had paid to be featured before being given the option to stay with their existing fund. The CHOICE staff member felt a user might need to be familiar with superannuation guidelines or read the information presented thoroughly in order to know that they can retain their current fund.

How ‘dark patterns’ nudge users towards Slate Super

‘Dark patterns’ are features of a website or user interface that are designed to manipulate a consumer into taking certain actions.

Chandni Gupta, digital policy director at Consumer Policy Research Centre (CPRC), says the onboarding platform uses ‘dark patterns’ to encourage users to select the option (in this case, Slate Super) the platform-maker wants.

“While it looks like you have options, there is very little detail, including no information on fees and charges, to easily compare the funds in a meaningful way.”

This is a classic example of the dark pattern known as false hierarchy, where the preferred options stand out to look more attractive … regardless of whether they are in your best interes

Chandni Gupta, Consumer Policy Research Centre

“Additional information is buried in the small, fine print under the bright ‘Choose this fund’ buttons. This is a classic example of the dark pattern known as false hierarchy, where the preferred options stand out to look more attractive through colour, size or placement regardless of whether they are in your best interest.

“It’s deeply unfair but unfortunately a very common practice.”

CPRC research found that 83% of Australians have been negatively impacted due to design features on a website or app that are aimed at influencing their behaviour.

Super Consumers Australia policy manager Franco Morelli says a platform user could think they were joining a recommended fund.

“This business model has the potential to dismantle years of pro-consumer reforms which have been helping Australians enjoy more retirement income”

Franco Morelli, Super Consumers Australia

“There should always be a place for people to choose their own fund but it can’t be in an environment where they are tricked into thinking it’s good.”

A digital platform to help you choose a fund may sound good in theory, but industry representative group, the Australian Institute of Superannuation Trustees, has expressed concern that these platforms could tie “hundreds of thousands of young Australians” to ill-suited super products.

“The company doesn’t seem to be breaking any rules,” says Morelli. “But it is capitalising on the mess created by the current employer and ATO onboarding process which makes it unnecessarily difficult for people to keep a single, high-performing super fund.”

Beware ‘dark patterns’ that could steer you towards a poor-performing super fund.

MYOB gets payments for referrals

Not only does MYOB promote its own below-average performing super product through the platform, its business model exposes users to other potentially poor-performing products as well.

The HR software is free for employers to use. Instead, the company makes money through referral fees from the providers it promotes on the platform.

As the platform’s website states:

“The platform includes a benefits module where employees can access information about a range of employment benefits including superannuation, life insurance, novated leases and rewards.

The company makes money through referral fees from the providers it promotes on the platform

“[The platform] may receive payments for referring employers or employees to third party product or service providers in connection with the benefits module.”

This commercial arrangement means that super funds with poor investment returns or that are charging high fees (or both), could be featured on the platform. Meanwhile, it’s possible that high-performing funds may not appear if they haven’t chosen to pay MYOB to be featured.

Is Slate Super even a good option?

Slate Super reports it already has more than 100,000 members. It’s a fast-growing fund that’s succeeding where other startup super funds have failed.

For context, other new entrants Spaceship Super (10,184 members as of June 2021), Zuper and FairVine (which both closed having failed to reach sufficient scale) did not experience anywhere near the same growth.

In an email to Super Consumers Australia, MYOB stated only 1.5% of employees who used the MYOB Flare HR platform became fee-paying members of Slate Super. MYOB says Flare’s integration with the MYOB platform is just one way a consumer will find Slate Super, and that the fund is marketed “through direct marketing, word of mouth and other partners”.

However, Slate Super’s Annual Member Meeting notice shows a spend of $0 on promotion, marketing and sponsorship expenditure for the 2020/21 financial year.

Media reports have stated that more than one million Australians have used the platform.

But because Slate Super is a ‘choice’ superannuation product, rather than a MySuper product (these are the simpler, low-cost products you can be defaulted into if you don’t choose your own super fund), Slate Super isn’t quality tested as part of the government’s YourSuper comparison tool and related performance test.

The Productivity Commission found a 0.5 percentage point increase in fees can cost a typical full-time worker $100,000 by retirement

“The super fund comparison tool and associated performance test are vital consumer protections,” says Morelli. “It’s by far the easiest way for Australians to compare how their fund is doing on fees and performance. There are also real consequences for failing the test, with a fund that fails twice in a row being barred from taking on new members.”

Slate Super hasn’t proven to be a high performer. In the 2020/21 financial year, its returns were lower than the industry average. The highest growth stage of Slate Super returned 13.44% in this financial year. Meanwhile, the industry average for lifecycle products with similar growth stages was 21.8%.

Slate Super charges $645.50 in fees for a $50,000 balance. This number is almost 30% higher than the overall industry average of 1%, or $500, for this balance. The fund has conceded that “administration fees are significantly higher cost than the peer fund median across all investment options”.

The $50,000 figure is used as a default balance in the non-personalised version of the YourSuper comparison tool to assess fees of each assessed product, and is widely used across the industry.

While the difference in fees between a high-fee fund and a median-fee fund may seem relatively minor, it’s important to remember how these costs can add up over the length of your working life and eat into your retirement income. For instance, the Productivity Commission found a 0.5 percentage point increase in fees can cost a typical full-time worker $100,000 by retirement.

Why we have default super funds

In considering whether this new platform is a positive innovation for fund members, it’s worth going back to what the industry looked like before the current consumer protections.

First, the government introduced ‘MySuper’ products to lower overall fees and ensure the large number of disengaged people were being defaulted into simple, broadly suitable products.

Since 2014, if you opt not to nominate your own super fund when you start a new job, you’ll be defaulted into a MySuper product, which is intended to be low-cost and suitable for most people.

Being in an underperforming product instead of a high-performing product throughout your working life could cost you over $500,000

But not all MySuper products performed well. An underperforming product can have massive consequences for your retirement income.

For example, the Productivity Commission found that being in an underperforming product instead of a high-performing product throughout your working life could cost you over $500,000.

Consumer protections introduced

In 2021, the government introduced a new super fund performance test to address the problem of poor investment returns. Importantly, this test introduced real consequences for a fund that fails – now, a fund that fails two tests in a row can’t accept new members. This means that when people change jobs, they can’t be offered a failed product.

This performance test is helping to ‘cut off the tail’ of underperforming funds, forcing them to merge or improve.

These changes have yet to apply across the market; there’s still a large number of super products (known as ‘choice products’ – named because you have to actively ‘choose’ to join them) that still need to be tested.

The intention of these reforms is clear: to help people enjoy more retirement income by staying in one high-performing fund throughout their working lives

Finally, the government introduced ‘stapling’ in November 2021. This change means your super fund now follows you when you change jobs, unless you actively choose to start a new account. This reform was designed to prevent people adding a new super account whenever they changed jobs.

The intention of these reforms is clear: to help people enjoy more retirement income by staying in one high-performing fund throughout their working lives.

In theory, a software platform to help you select a good super fund could make sense. But when the party purporting to help you do this has a commercial interest in which fund you select, consumers can lose out.

Filling in forms is often part of the onboarding process for employees starting a new job.

Bypassing default system undermines consumer protections

The MySuper system was designed so that fund members who don’t make an active choice are protected and at least stay in a low-cost MySuper product that’s suitable for most people.

Morelli says that the reach of MYOB and other fintech companies or software providers could frustrate the pro-consumer goals of the default system and the ‘stapling’ reforms.

“In this business model, people must actively choose to stay in their low-cost super product. This feature is a departure from the default system and stapling set up to protect disengaged consumers,” says Morelli.

If we don’t get the employee onboarding process right, there’s a risk that these pro-consumer reforms will be completely undermined

Franco Morelli, Super Consumers Australia

“The expert view is that the platform is nudging people away from the default products designed to suit most Australians, and into a fund whose brand MYOB owns through its subsidiaries, and which isn’t subject to the government’s performance test and charges high fees.

“Encouraging people to select a new account could also supercharge multiple accounts that eat into people’s retirement income. The whole point of stapling was to end the waste of unintended duplicated accounts.

“If we don’t get the employee onboarding process right, there’s a risk that these pro-consumer reforms will be completely undermined.”

Keeping a single, high-performing fund should be easy for all

It’s easy to see why an onboarding platform that makes choosing super easy would appeal to some people – the Australian Taxation Office (ATO) process to keep your fund when you change jobs is time-consuming and overly complicated.

The ATO provides a superannuation standard choice form that employers can provide to new employees to choose a super fund.

People can avoid creating a duplicate by simply not filling in this standard choice form. But they may not know they have this option, or they may not take it up, particularly when starting a new job and wanting to make a good first impression by filling in any forms given to them by their employer.

What we’re seeing with MYOB is a clever way to grab market share by capitalising on the mess that is the super onboarding process

Franco Morelli, Super Consumers Australia

And if you do use the ATO’s standard choice form and want to stick with your current fund, you must complete ten data points, including technical information like your fund’s Australian Business Number (ABN) and Unique Superannuation Identifier (USI). On the other hand, choosing your employer’s default super fund can be as easy as ticking a box.

Apart from using a platform such as the MYOB product, employers can also make their own standard choice form. This means an employer can give an employee a choice form pre-filled with their default super fund. The worker can simply fill in their name and tax file number to join that fund.

Allowing employers or third-party platforms to funnel people into choosing a particular product is delivering demonstrably poor outcomes compared to what the default super system is likely to deliver, says Morelli.

“People should have independent information to make choices.”

One onboarding system needed

Super Consumers Australia says the ATO must step in to provide the same centralised onboarding service to all new employees. We have contacted the Treasury with our concerns about the implications of this new business model.

The ATO is already providing a useful service to help consumers find a good super fund with its objective, independent comparison tool.

“What we’re seeing with MYOB is a clever way to grab market share by capitalising on the mess that is the super onboarding process,” says Morelli.

“If the government doesn’t act, we could end up in the situation the Productivity Commission warned of, with companies funnelling people into super funds that have bypassed the default system safeguards, and that will leave people with less retirement income.”

Correction 21 Mar 2023: An earlier version of this story stated that 1.5% of Slate Super members joined through the Flare HR platform. The correct statistic is that 1.5% of people who used Flare HR joined Slate Super.

This content was produced by Super Consumers Australia which is an independent, nonprofit consumer organisation partnering with CHOICE to advance and protect the interests of people in the Australian superannuation system.