Why an underperforming super fund could cost you hundreds of thousands of dollars

See how your super fund compares.

Need to know

- You’re put into a MySuper fund if you don’t nominate a superannuation fund when you start a new job

- Being with a default MySuper fund in the bottom quarter of the performance ladder could cost you $660,000 over the course of your working life

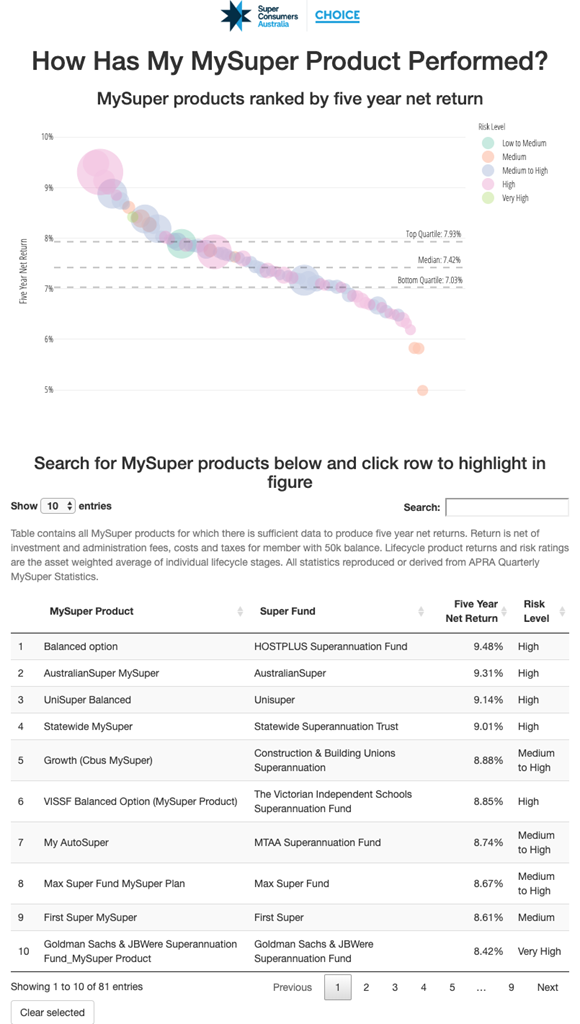

- These MySuper products have returned 7.03% or lower over the last five years we have data for

Could I be missing out on super savings?

The answer is yes. Last year, the Productivity Commission did a deep dive into Australia’s super system.

It found there were about 4.6 million Australians in underperforming MySuper products.

MySuper funds are the ‘default’ for people who don’t nominate a superannuation fund when they start with a new employer.

About 4.6 million Australians are in underperforming MySuper funds

Analysis by Super Consumers Australia at CHOICE has found that in the last 12-month period we have data for, more than 176,000 new super accounts were created with ‘poor performers’. These are defined as MySuper products that have been underperforming over a five-year period.

Most of these people would have ‘defaulted’ into these underperformers when they started their jobs.

Are you in an underperforming super fund?

In one calculation, having an underperforming MySuper account could be the difference between retiring with $560,000 in super or $1.2 million in super.

But what’s the magic number that defines good performance for a super product?

Research by Super Consumers Australia at CHOICE found that the top-quartile MySuper products over the past five years returned at least 7.93% for their members.

And the duds? The MySuper products in the bottom quartile returned 7.03% and lower.

You can use our tool to search for your MySuper fund and see if it’s in the bottom quartile for performance

How an underperforming super fund can cost you

The difference between the top quartile (25%) of MySuper funds and the lowest quartile (25%) is jaw-dropping.

The Productivity Commission calculated that if you start with a salary of $50,000 a year, enter the workforce at 21, and are with a median bottom-quartile fund, you’ll end up with $560,000 of super when you retire.

And if you start at the same age and salary but are with a median top-quartile fund? You’ll retire with $1.2 million.

That’s a whopping $660,000 more in retirement, even if you took home the same pay every week for your entire career. And it’s 54% more to spend after you finish your working life.

Just let that sink in for a bit.

Having an underperforming super fund can be disastrous down the track

James Gerrard, Financialadvisor.com.au

Think about what this extra money would mean for you in practical terms.

You could take holidays to see friends and family living overseas. You could have peace of mind, knowing you could do things such as upgrade your car and comfortably afford groceries and utility bills. You could even buy CHOICE subscriptions for your loved ones (wink).

“Given that most Australians retire with less than what they require for retirement, having an underperforming super fund can be disastrous down the track,” says James Gerrard, director at Financialadvisor.com.au.

Case Study: Underperforming fund leaves client $50-100k worse off

Kyle Frost, a financial advisor at Millennial Independent Advice, has worked with many people on their retirement plans. He says he recently saw an extreme example of an underperforming super fund when a client, a 67-year-old woman, was referred to him for advice. Her super was with MLC and had returned just 2.92% a year since 1998.

Frost says it was too late to turn her savings around: “I could have rehashed the numbers and said, ‘If you’d been with another fund 20 years ago, your account would literally be 50 or 100,000 dollars better off’… but what’s done is done. It could have been a hugely different situation.”

Frost’s client had simply been unlucky. She had done what many Australians do – stuck with the fund her employer defaulted her into. Advisers from MLC got in touch with her and tried to move her into other products, but she wasn’t engaged with her super and never made the change.

In her case, a combination of now obsolete fees and poor performance meant she lost out in the ‘lottery’ of super. She now faces a very different lifestyle in retirement from the one she might have had.

How to switch to a better performing super fund

Switching to a better-performing fund is easier than many people realise. Consolidating your accounts or starting a new one can be done in minutes.

- If you currently have multiple super accounts, you can combine them through the MyGov website.

- If you’ve found you’re in a underperformer and want to change, ASIC’s MoneySmart has some good practical advice on how to find a better fund

- We give you more tips in our article ‘How to take control of your super’

The impact of a dud super product can be absolutely massive on the type of lifestyle you can afford in retirement.

“People should focus on underperformance as there is more evidence that bad products continue to perform poorly over time,” says Matthias Oldham, researcher and data analyst at Super Consumers Australia.

“Most people with a MySuper product did not actively choose it and only have limited engagement with it.

“If you’re with one of the worst products, you should consider getting out as soon as possible.”

Correction, 4 October 2019: The original article contained incorrect returns data for the Suncorp Lifestage product. The issue meant the originally calculated annualised average returns of 6.85% has been revised up to 7.22%.

This content was produced by Super Consumers Australia which is an independent, nonprofit consumer organisation partnering with CHOICE to advance and protect the interests of people in the Australian superannuation system.