Characteristics of super funds merging in 2019 and 2020

Video Overview

Background

The Financial Services Royal commission, APRA’s member outcomes framework, the Productivity Commission report and the Protecting Your Super legislation all heightened scrutiny on underperforming superannuation funds. The Productivity Commission found greater merger activity was part of the solution to underperformance, as it would lead to efficiency through economies of scale, ultimately benefiting consumers. We test this thesis by considering the impact of merger activity between January 2019 and December 2020 on consumer outcomes, measured in terms of fees.

This analysis will also uncover if current merger activity is occurring among the underperforming funds identified by the regulator APRA, via its heatmaps. Finally, it will make an assessment as to whether the current rate of merger activity is sufficient to drive systemic change, or if further steps are needed to encourage merger activity, for example via the Federal Government’s recently announced Your Future, Your Super legislation.

Sample

We define a merger as a voluntary fusion of two super funds into a single legal entity. We include joint ventures where funds have consolidated functions but maintain separate brands e.g. the Equipsuper/Catholic Super (MyLifeMyMoney) merger. We do not include acquisitions where there is no evidence of the consolidation of functions and distinct product offerings remain e.g. the acquisition of Onepath by IOOF that was finalised in January 2020. We include all mergers which occurred in the period January 2019 through December 2020. This leaves us with fifteen mergers involving twenty four funds (see appendix A for fund details). Eleven of these mergers were completed during this period and four are yet to be finalised.

Impact of merger activity on fees charged to fund members

Finalised mergers

Our analysis of the fee impact of merger activity focuses on the eight finalised mergers for which we have information about the fees charged by the merged fund. Four of these took place in 2019, four in 2020. Six have produced a single successor fund and two involve a consolidation of functions but the maintenance of two distinct product offerings.

Fund fees pre and post merger

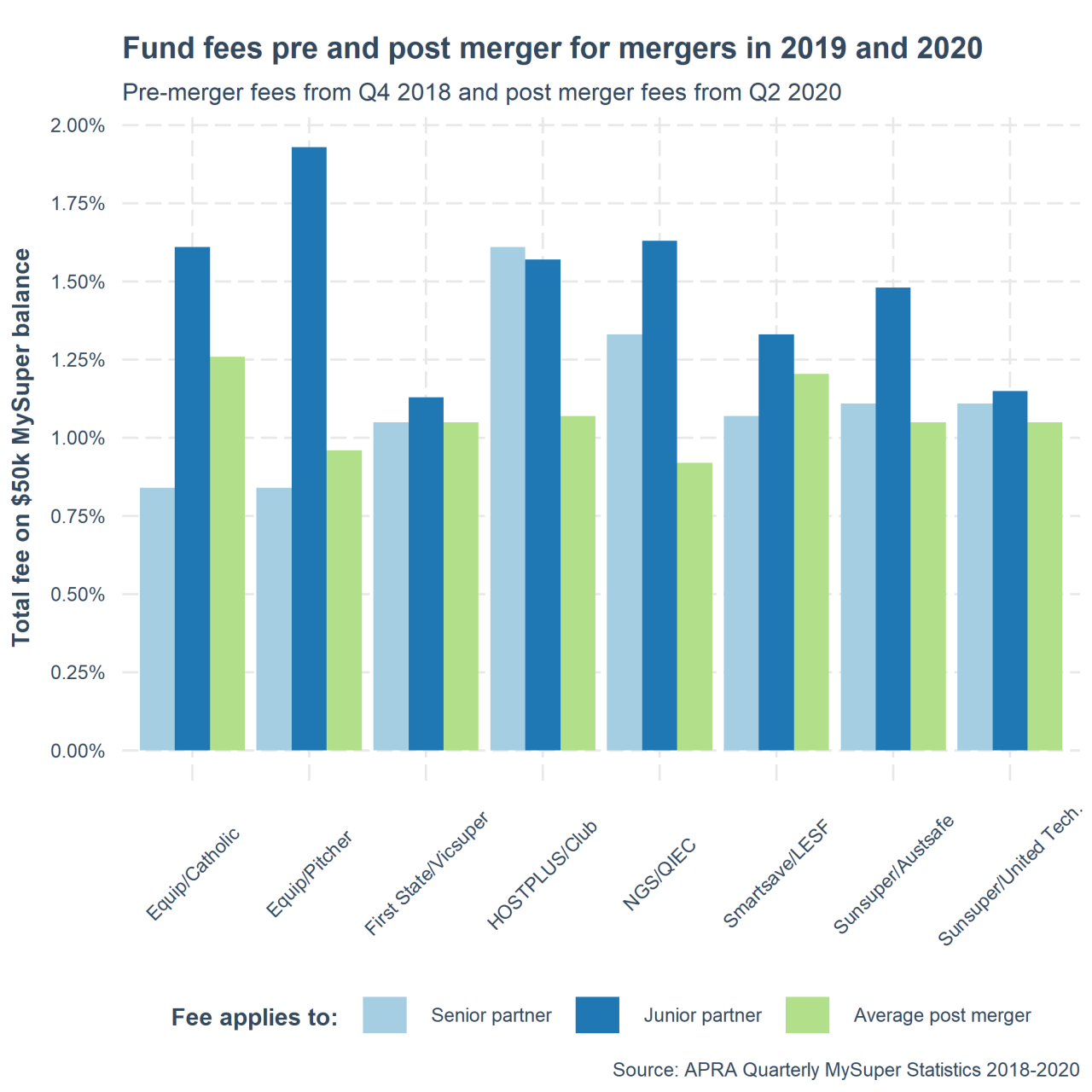

Figure 1

fund fees pre and post merger

We first assess the impact of merger activity on fund fees by reviewing the post-merger fee (on a 50k balance) of the successor fund(s) against the pre-merger fees of each merger partner. Figure 1 visualises this information. In all eight cases, the post-merger fee charged to members of the junior partner is less than their pre-merger fee. For senior partners, fees fall or stay the same in five out of the eight cases and rise in the remaining three. Where this happens, it is due to an increased fee charged by the senior partner.

Aggregate impact on merging fund members

The un-weighted average fall in fees charged for all funds involved in merger activity is 17%. This is similar to the 20% reduction reported in an industry report that looked at 13 mergers completed between 2018 and 2020.1 Weighting by fund size (member accounts) to account for variance in fund size results in a smaller but still substantial fall of 13.4%.

In order to assess whether the substantial decline is reflective of the merger activity itself or broader industry trends, we can compare the change in fees for merging funds against the change in fees of all MySuper products. The member-weighted change for all MySuper products is a decline of 2.76%. Merger activity thus appears to be associated with larger declines in fees charged than can be explained by industry wide trends.

Overall impact assessment

We found a 13.4% member weighted decline in fees for our sample of eight mergers finalised in 2019 or 2020 while industry wide fees only declined 2.76% over the same period. In all mergers, members of the junior merger partner were made better off. Members of senior partners were also at least as well off in five of the eight mergers. In the other mergers senior partner fees increased during the merger period, rendering the majority of the combined membership worse off.

Investment performance of merging funds

Whole of fund performance of merging funds

Table 1

| Level | Performance metric | Sample | Mean | SD | Median |

|---|---|---|---|---|---|

| Fund | Fund five year net return | All funds | 6.4% | 1.3% | 6.4% |

| Fund | Fund five year net return | Merging funds | 7.4% | 1.0% | 7.5% |

| Fund | Fund five year net return | Senior partners | 7.9% | 1.2% | 8.1% |

| Fund | Fund five year net return | Junior partners | 7.0% | 0.7% | 6.8% |

| Fund | Fund ten year net return | All funds | 7.2% | 1.2% | 7.5% |

| Fund | Fund ten year net return | Merging funds | 7.8% | 0.9% | 7.9% |

| Fund | Fund ten year net return | Senior partners | 7.9% | 1.2% | 8.3% |

| Fund | Fund ten year net return | Junior partners | 7.6% | 0.6% | 7.7% |

Table 1 provides the five and ten year investment returns for all large APRA regulated funds, all merging funds in our sample and senior and junior merger partners only, respectively. We can see that our merging funds have larger five and ten year returns on average than all APRA funds. This result holds for both senior and junior merger partners, although senior partners have substantially higher values than junior partners over both five and ten years.

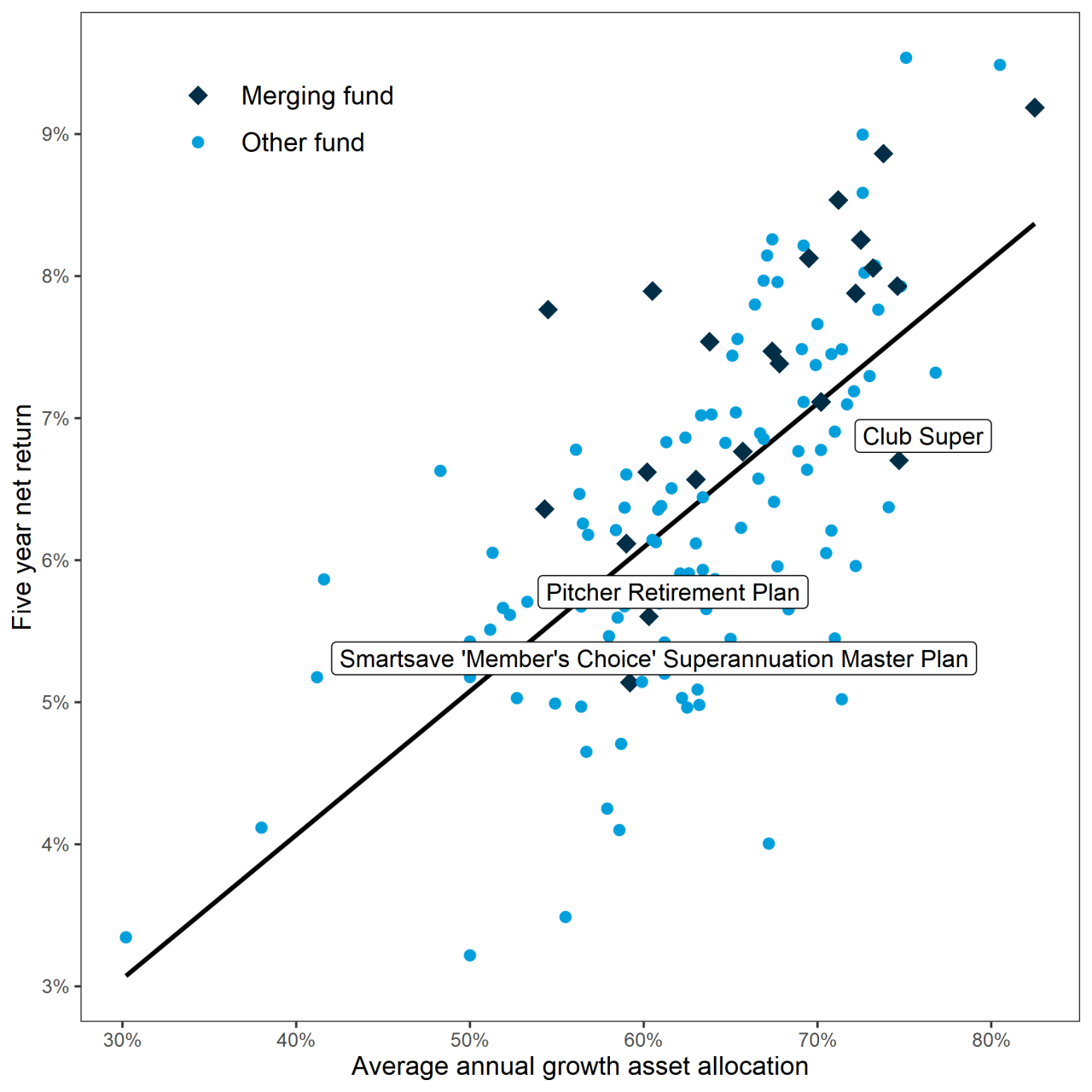

Figure 2 – Five year risk adjusted rate of return

We can also assess fund level performance on a ‘risk-adjusted’ basis. We follow the methodology used by APRA in the data insights paper accompanying the December 2019 heatmap. Figure 2 plots a measure of investment risk against the five year annualised net return (as of June 2019) all APRA regulated funds. Merging funds (except for the two funds which no longer existed by that time) are denoted by diamonds. The black trend line shows the average return APRA funds achieved for a given risk profile. We see that 18 of the 22 merging funds exceed the industry average and only three funds fall substantially below it (Pitcher Retirement Plan, Smartsave Super and Club Super). This suggests our merging funds also perform relatively well on a risk-adjusted basis.

Risk adjusted MySuper product performance of merging funds

Table 2

| Fund name | Product vs simple reference portfolio | Product vs strategic asset allocation portfolio | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| Perpetual | -0.88% | -1.32% | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| LESF | -0.67% | -0.95% | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Club Super | -0.22% | -0.88% | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| IAG & NRMA | -0.48% | -0.83% | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| United Technologies | -0.52% | -0.76% | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Pitcher | -0.69% | -0.74% | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| WA local Gov. Super | -0.04% | -0.44% | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Smartsave | 0.08% | -0.24% | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| MyLifeMyMoney | 0.39% | -0.06% | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| NGS Super | 0.57% | 0.05% | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Victorian | 0.25% | 0.30% | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Media Super | 0.63% | 0.33% | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Sunsuper | 0.55% | 0.46% | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Hostplus | 0.91% | 0.50% | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| First State | 0.61% | 0.54% | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Equipsuper | 0.83% | 0.70% | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Care Super | 1.00% | 0.71% | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| MTAA | 1.20% | 1.35% | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| CBUS | 1.74% | 1.37% | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Qsuper | 1.61% | 1.84% | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| * Lifecycle product statistics are asset weighted averages | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

Whole of fund performance incorporates the performance of the funds assets under management over all their investment products. We can also take advantage of APRA’s ‘heatmap’ data releases to gauge the performance of a funds default product, which is usually also its largest product as a proportion of fund assets.

Table 2 shows us how the 20 MySuper products for which information is available perform against two measures of risk-adjusted performance. One of these – performance against a benchmark portfolio with the same strategic asset allocation as the product – is the bright line performance test proposed by the Government in it’s ‘Your Future, Your Super’ reform package.2 Six products underperform this metric by more than 50 basis points which is the threshold for underperformance in the test. All of these products are from junior merger partners and represent 40% of all junior partners.

Table 3

| Level | Performance metric | Sample | Mean | SD | Median |

|---|---|---|---|---|---|

| MySuper Product | Five year NIR vs SAA | All funds | -0.1% | 0.7% | -0.2% |

| MySuper Product | Five year NIR vs SAA | Merging funds | 0.1% | 0.9% | 0.2% |

| MySuper Product | Five year NIR vs SAA | Senior partners | 0.6% | 0.5% | 0.5% |

| MySuper Product | Five year NIR vs SAA | Junior partners | -0.3% | 0.9% | -0.7% |

| MySuper Product | Five year NIR vs SRP | All funds | 0.2% | 0.7% | 0.0% |

| MySuper Product | Five year NIR vs SRP | Merging funds | 0.3% | 0.8% | 0.5% |

| MySuper Product | Five year NIR vs SRP | Senior partners | 0.8% | 0.5% | 0.8% |

| MySuper Product | Five year NIR vs SRP | Junior partners | -0.1% | 0.7% | -0.2% |

Table 3 lets us compare the average performance across the risk adjusted performance measures in the heatmap for all MySuper, merging fund, senior partner and junior partner products, respectively. We find that across both measures, merging funds perform better than the average MySuper product. This result is driven by the performance of senior merger partners, which is substantially higher than the average for all products and all merging fund products. In contrast, junior merger partners perform poorly relative to both all products and all merging products.

Overall investment performance characteristics of merging funds

At whole of fund level, the investment performance of merging funds is strong both on average and on a risk-adjusted basis, whether they are junior or senior merger partners. At MySuper level, a substantial minority of junior merger partners display strong underperformance (defined as underperforming a benchmark portfolio with the same strategic asset allocation by more than 50 basis points). Junior partners also perform substantially worse on average than other products.

Defining underperformance as either underperforming on a risk-adjusted basis at whole of fund (more than 50 basis points below the industry average at a particular level of investment risk) or at MySuper product level (more than 50 basis points below the SAA benchmark portfolio), we find 7 underperforming funds out of a total of 24, or 29% of all merging funds. These include six with poor MySuper product performance and three with poor fund level performance. Six of the seven underperforming funds are junior merger partners, indicating that underperformance in merging funds is concentrated in the junior partners.

Conclusions

We find fund mergers are generally beneficial to fund members with respect to fees charged. On average, fees decline 13.4% on a member weighted basis in our sample of merging funds versus 2.76% for the industry as a whole over the sample period. In all mergers considered members of the junior partner (the smaller fund) experience reduced fees, as do members of the majority of senior partners.

We find that 29% of the funds in our sample can be classified as underperformers in terms of their investment performance and that they are involved in 40% of the mergers we analysed. All of these underperforming funds have already finalised their mergers.

While we have therefore seen significant merger activity involving underperforming funds in the last two years, all four mergers to be finalised in 2021 do not feature any underperforming funds. In addition, all of the recently merged underperformers are small funds (relative fund size defined in appendix B).

Analysis of the December 2020 APRA heatmap shows that 20 products from 18 funds currently fail the performance benchmark specified in the government’s proposed Your Future, Your Super reforms. Of these, half are large or very large funds. Assets from these funds would make up a substantial proportion of the combined asset pool in any potential merger, impacting the future performance of the merged fund to a much greater degree than the small underperformers in our sample. This may curtail the extent of future merger activity involving underperformers.

We see a role here for the government’s proposed bright line performance test, which will put additional pressure on all funds to improve their investment performance or face a freeze on new members, turning off the asset tap. This additional impetus to perform well will be especially important for incentivising large underperforming funds where merger activity is more challenging.

Appendix A – Size characteristics of merging funds

| Fund name | Member accounts | Total assets |

|---|---|---|

| Pitcher | 1,034 (very small) | 0.1bn (very small) |

| United Technologies | 1,852 (very small) | 0.3bn (very small) |

| Smartsave | 6,523 (small) | 0.2bn (very small) |

| Perpetual | 14,142 (small) | 1.5bn (small) |

| IAG & NRMA | 14,225 (small) | 2.2bn (medium) |

| Club Super | 20,918 (small) | 0.6bn (small) |

| QIEC | 25,407 (medium) | 1.6bn (medium) |

| LESF | 28,555 (medium) | 0.2bn (very small) |

| WA local Gov. Super | 56,398 (medium) | 4bn (medium) |

| Equipsuper | 72,845 (large) | 16.1bn (large) |

| MyLifeMyMoney | 75,648 (large) | 10.2bn (large) |

| Media Super | 77,796 (large) | 6.1bn (large) |

| Australian Catholic | 91,590 (large) | 9.6bn (large) |

| NGS Super | 117,824 (large) | 11.7bn (large) |

| Austsafe | 118,647 (large) | 2.9bn (medium) |

| Tasplan | 137,507 (large) | 11.4bn (large) |

| MTAA | 204,702 (very large) | 12.8bn (large) |

| Care Super | 245,598 (very large) | 19.9bn (very large) |

| Victorian | 248,032 (very large) | 25.2bn (very large) |

| Qsuper | 588,434 (very large) | 115.3bn (very large) |

| CBUS | 766,494 (very large) | 53.2bn (very large) |

| First State | 861,118 (very large) | 103.1bn (very large) |

| Hostplus | 1,193,243 (very large) | 46bn (very large) |

| Sunsuper | 1,613,865 (very large) | 72.6bn (very large) |

Appendix B – APRA fund size quintiles

| Size metric | Stat | Q1 (very small) | Q2 (small) | Q3 (medium) | Q4 (large) | Q5 (very large) |

|---|---|---|---|---|---|---|

| Member accounts | median | 1,356 | 8,724 | 31,577 | 95,618 | 474,772 |

| Member accounts | range | 22-4257 | 4660-21238 | 21796-72443 | 72845-183662 | 186212-2155463 |

| Total assets (Bn) | median | 0.21 | 0.86 | 2.86 | 9.58 | 53.82 |

| Total assets (Bn) | range | 0-0.44 | 0.45-1.77 | 1.86-5.27 | 5.42-16.12 | 16.66-172.41 |

Pareto principle applies to super funds

In terms of both member accounts and total assets APRA regulated funds follow the Pareto principle. That is, roughly 80% of accounts and assets are controlled by 20% of the funds, as illustrated in Figure 4. Fund size does not increase linearly but exponentially, so the relative categories should be interpreted as an ordinal rather than an interval scale. In other words, the difference in size between a top quintile i.e. “very large” fund and all other funds is much greater in magnitude than the differences between each of the other quintiles e.g. the difference in size between “medium” and “small” funds.